-

Features

-

Software

-

-

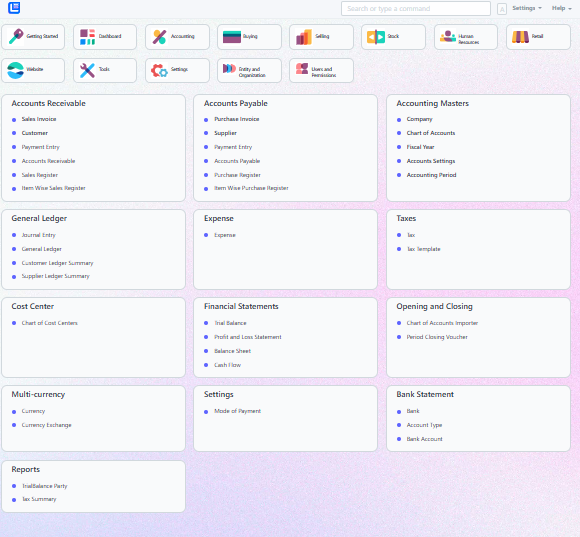

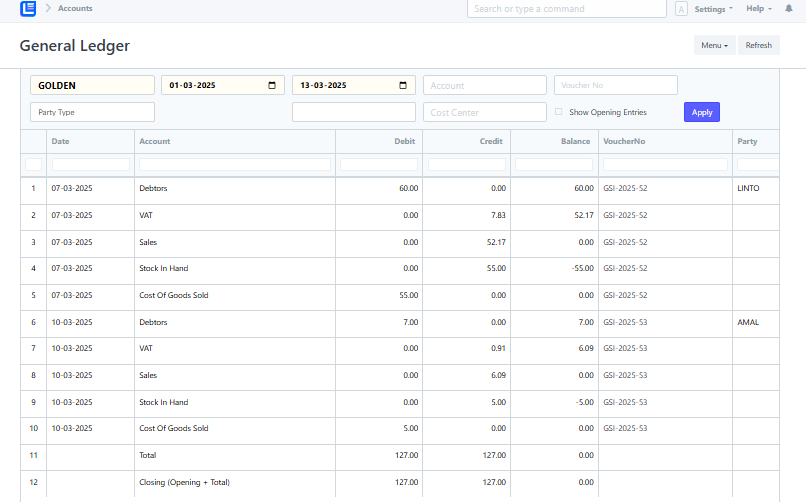

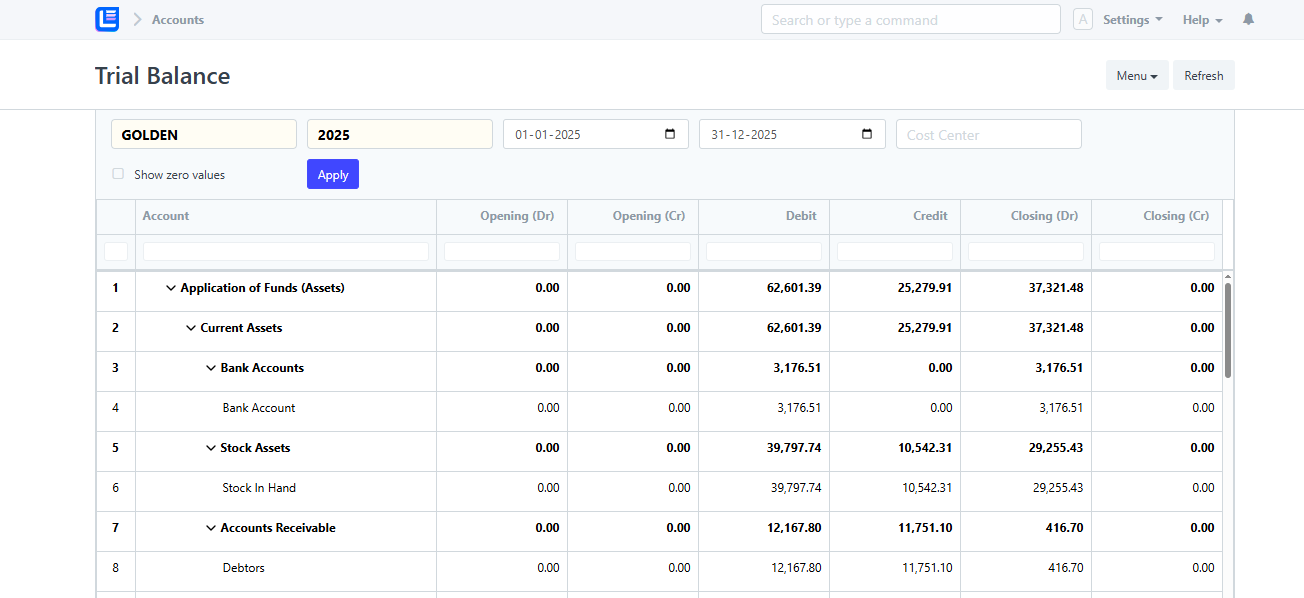

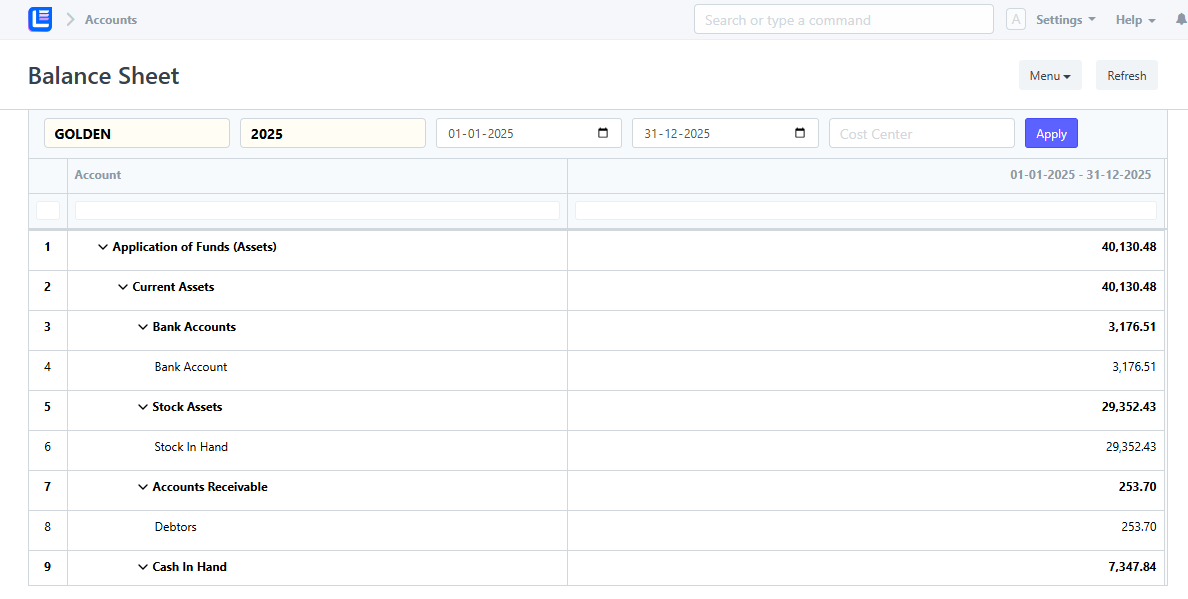

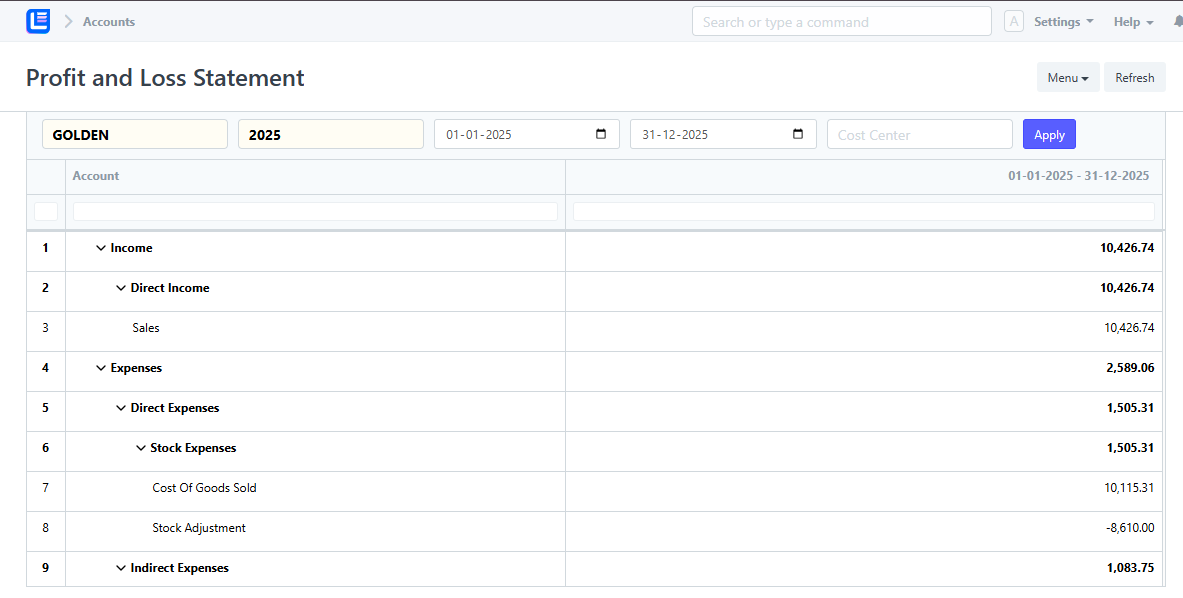

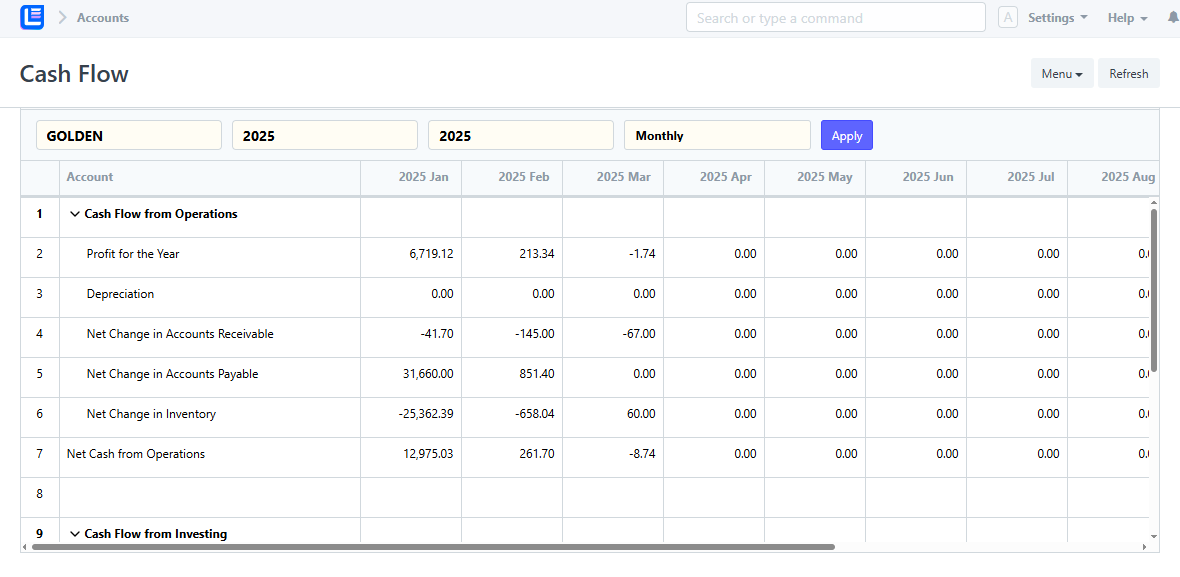

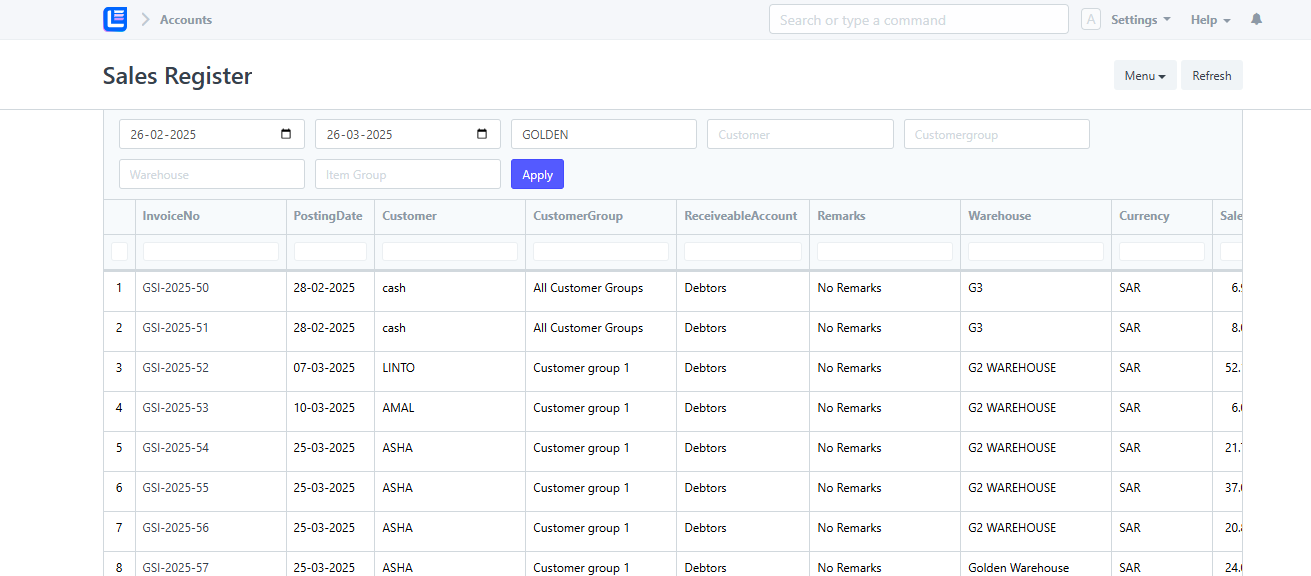

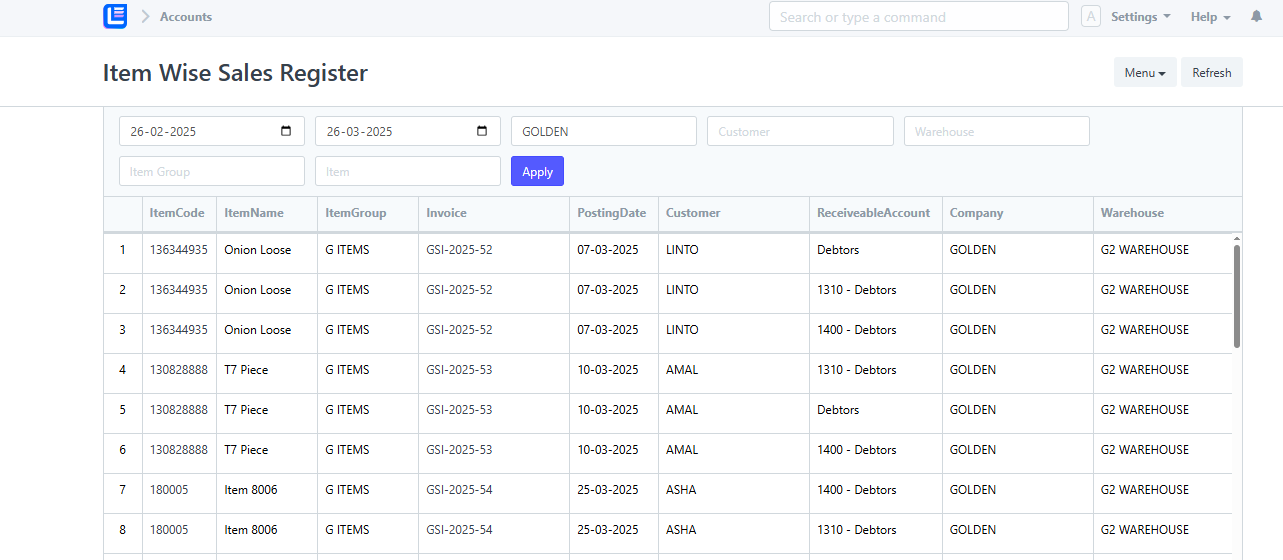

ERP

- Comprehensive business management solution

-

ERP Cloud

- All-encompassing business management solution

-

Van Sales Cloud

- Sales Operations

-

ERP

-

-

Restaurant

- Comprehensive Point of Sale (POS) system for managing restaurants

-

Retail

- Comprehensive solution for managing retailers

-

Wholesale

- Designed for wholesale businesses

-

Supermarket

- Comprehensive solution for managing supermarket

-

Restaurant

-

-

LanaTime Web

- Powerful Web-based Time & Attendance Software

-

LanaTime Web Cloud

- Powerful Time & Attendance Software

-

LanaTechTime

- Powerful Web-based Time & Attendance Software

-

LanaTechTime Cloud

- Powerful Time & Attendance Software

-

LanaTime Web

-

-

LanaTime Web

- Powerful Web-based Time & Attendance Software

-

LanaTime Web Cloud

- Powerful Time & Attendance Software

-

LanaTechTime

- Powerful Web-based Time & Attendance Software

-

LanaTechTime Cloud

- Powerful Time & Attendance Software

-

Gym Time

- Secure member verification

-

Visitor Management

- Automating visitor registration

-

Hostel Management

- Management of member and attendance data

-

LanaTime Web

-

- Lana Store

- Solution

- Case

- Technology

- Support

- Download